Google Revolutionizes the Mobile Wallet Experience for Android

Anthony Saia Director, Product

Share to my network

In this article

Categories

Book a meeting

Connect with our team of experts to discuss your conversion and loyalty goals, and how we can help you achieve them faster.

Get a demoThis year at Google I/O, we learned that the Google Wallet name would be revived with an updated wallet app for Android devices. While Google Pay (GPay) isn’t going away yet, Google Wallet app will replace Google Pay in 39 countries and will offer Android users expanded mobile wallet functionality.

It’s this expansion that Airship is most excited about. A new generic pass type opens up more use cases for brands to engage their customers with simple and seamless mobile experiences. Businesses must also make preparations for the Pay-to-Wallet name change, so read on to learn more.

The Big Picture

“Generic” anything doesn’t normally inspire, nor does it scream opportunity, but it does now! Google Wallet and Apple Wallet are now at parity for the types of mobile wallet pass experiences that can be supported. That’s a massive consideration for businesses that want to offer consistent, streamlined experiences across platforms, without care (or focus) for whether customers are using an Android or iPhone device.

Additionally, mobile wallet and contactless payment adoption soared during the pandemic. A recent survey found that contactless payments increased for 69% of retailers. This set of use cases was rather small, but extremely desired. Necessity breeds innovation, but in the digital age, innovation quickly becomes expected and establishes the new normal. Consider it took mere months into the pandemic’s onset for consumer preference for Buy-Online-Pickup-In-Store (BOPIS) to switch from the value of safety to one of convenience, per McKinsey. Similarly, mobile wallet use cases beyond the POS are set to explode. Businesses will reap benefits by having a direct line to their customers while also driving more users into the app experience.

Generic Means Adaptable

Previously, Google Wallet (er, GPay) offered seven pass types: loyalty card, offer, gift card, event ticket, transit ticket, boarding pass and vaccine card. All came with use-case specific fields and features.

Generic passes allow you to offer new mobile wallet experiences that don’t fit neatly into those use cases. Some of those may include:

- Membership cards (gym, library, club, etc.)

- Parking passes

- Stored value vouchers for redemption

- Driver insurance cards

- Reservations of various kinds

While generic pass types open up a wide variety of use cases, it’s more important to think about the customer experience and how you can streamline it. With Google Wallet and Apple Wallet there’s no app to download or website to visit, and the experience can be made almost automatic as passes are location-aware and can notify users in different scenarios.

For consumers, the mobile wallet offers extremely convenient access to a brand’s loyalty or membership cards. Wallet passes can also have a huge impact on driving app adoption for a brand’s most loyal customers if used properly. Marketers can include a link to download the app on the front and back of the pass, and incentivize installs with app exclusives, loyalty points or discounts. Apps can also recognize that a user has the brand’s pass in their wallet, and provide a cohesive loyalty experience with dynamic updates across both app and wallet experiences with incentives to keep them coming back to the app.

As brands continue to think about how their mobile experience can work in conjunction with their in-store experience, mobile wallets help in blending the two experiences by allowing brands to reward users for visiting a store or redeeming loyalty points via the app with an in-store purchase.

A Rose by Any Other Name Would Smell as Sweet

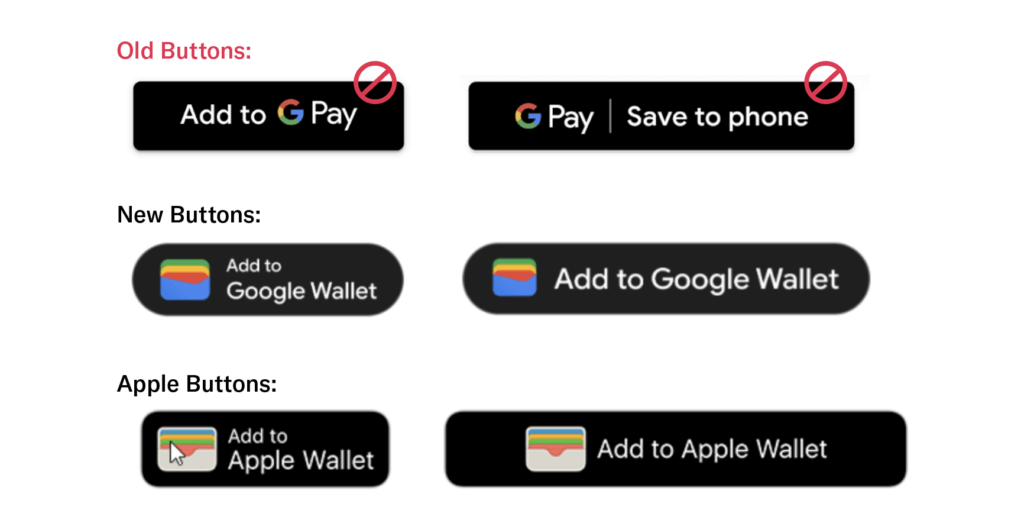

Android users are now starting to see the Google Wallet app update available for download. Brands that are using Google’s “Add to GPay” buttons will be expected to update to the new “Add to Google Wallet” buttons, across apps, websites, social networks and advertisements. No deadline date has been provided for this yet, but it is expected that all brands will need to follow these guidelines in order to keep their pass programs in compliance with Google Wallet brand guidelines.

Only Airship supports all pass types across Google and Apple. With Airship’s patented Adaptive Link technology, we’ve made it extremely easy — the only thing required by a brand is to add a single link to buttons or other distribution points (in-store QR codes, email, SMS, social, advertisements). Airship’s technology will auto-detect whether to serve a Google Wallet or Apple Wallet pass, and can automatically pull in customer information to both distribute and personalize the pass. This can include an external ID for connection to CRM, custom coupon codes, expiration date, user information and location. All of this information can be displayed on the pass for identification purposes. Tags can also be applied to passes to allow for audience segmentation, querying or applying dynamic pass updates in a streamlined way.

For more information, please visit Google’s provided Brand Guidelines & Assets, or contact us to learn how you can make the most of this contactless technology.