Financial experiences built for trust

Serve customers with secure, real-time journeys that strengthen confidence and streamline every interaction, from banking to insurance to wealth management.

BOOK A MEETING

Grow value with every interaction

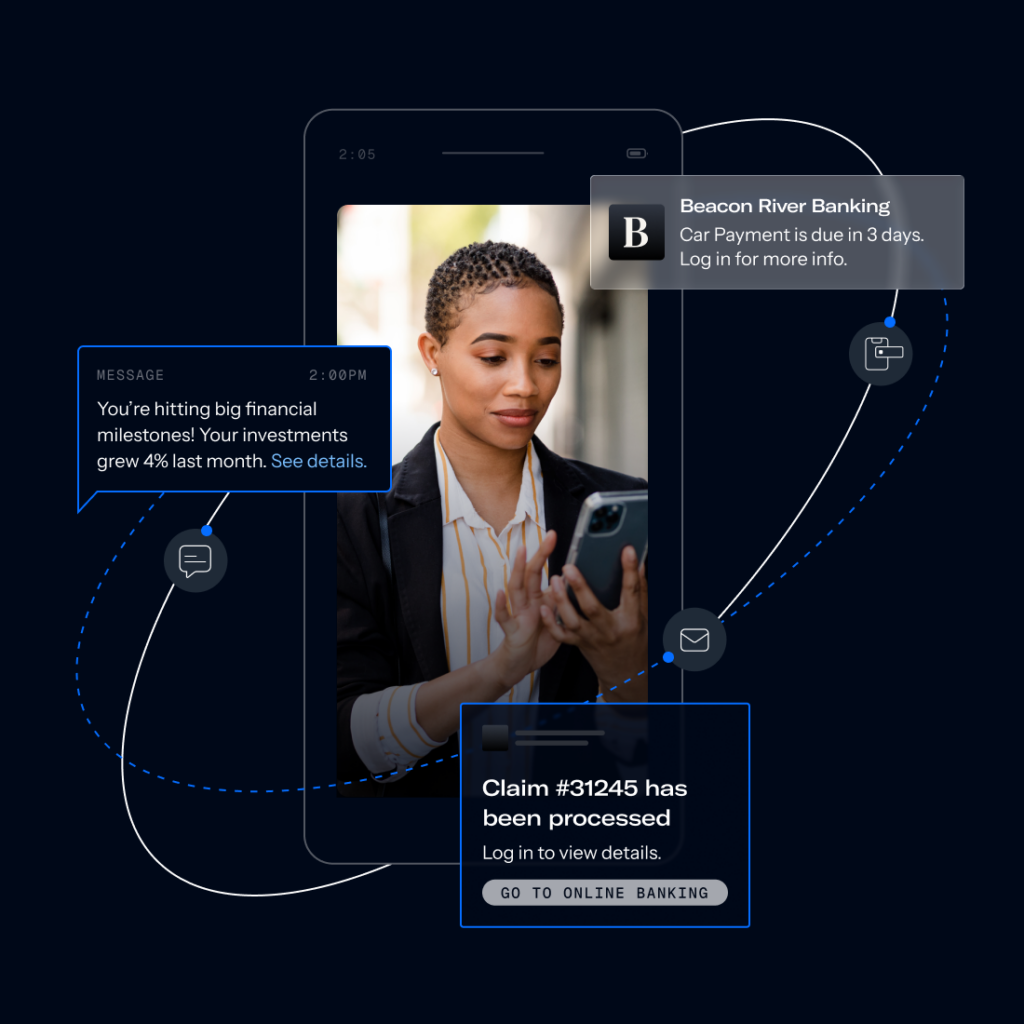

Want to send time-sensitive fraud alerts, claim updates, or personalized offers that actually get seen? We thought so. Our platform delivers the security and speed required to build confidence — ensuring your customers feel protected and valued whenever they connect.

Turn every transaction into a relationship

Reduce friction, increase satisfaction, and strengthen trust across every product line. Guide customers with proactive updates across loans, claims, payments, accounts, and portfolios. Exceed expectations with mobile-first personalized experiences.

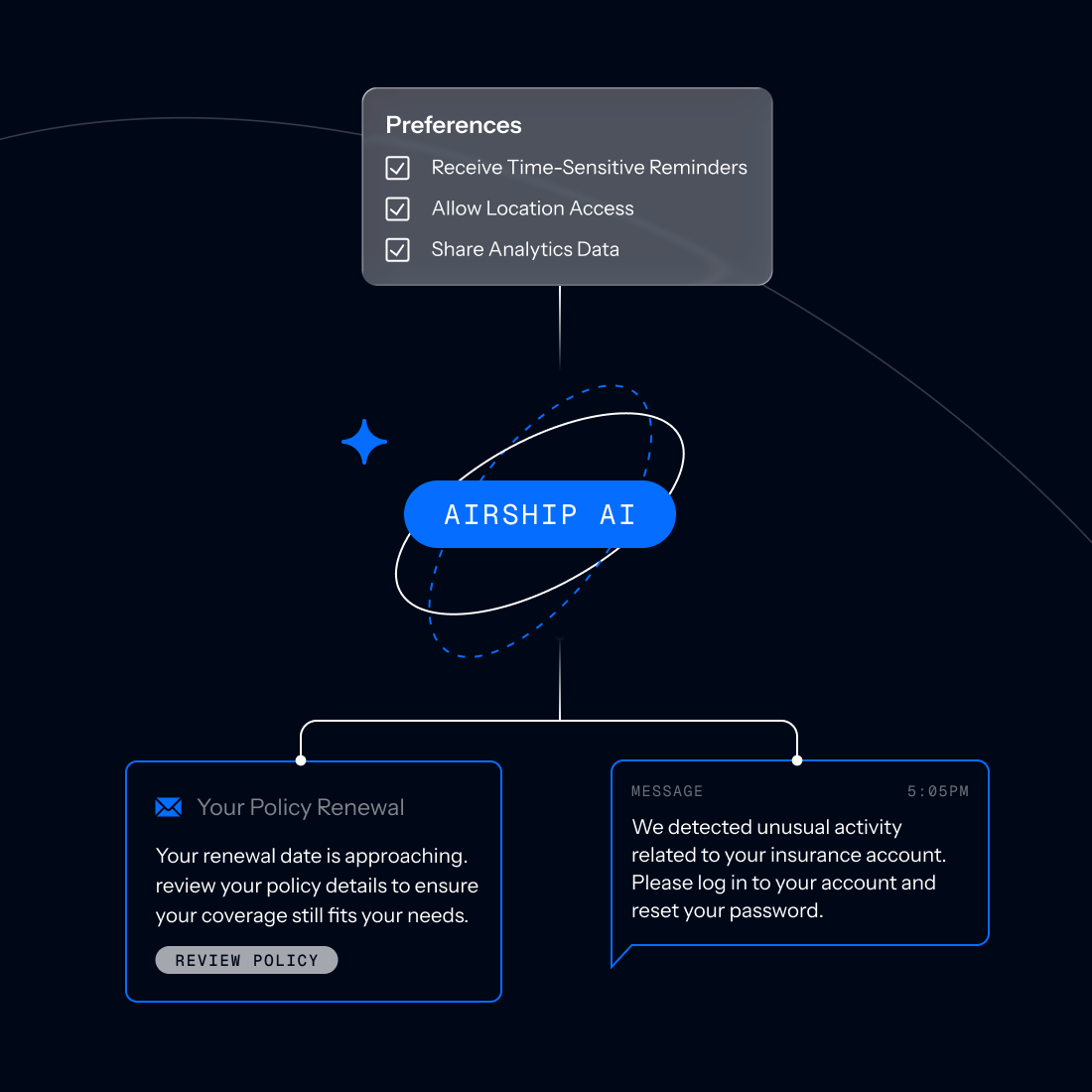

Personalize customer journeys with real intelligence

Use zero-party data, behavioral signals, and live account insights without added complexity. Deliver the right guidance, from fraud alerts to renewal reminders, exactly when needed. Turn intelligence into outcomes across banking, insurance, wealth, and payments.

Orchestrate secure, compliant customer experiences

Ensure every touchpoint is timely, secure, and aligned with customer expectations. Coordinate cross-channel journeys that honor regulatory standards and customer consent. Unify push, SMS, email, web, and in-app interactions to deliver clarity during important financial moments.

Transform data into predictive outcomes

Use AI recommendations to keep every financial experience on track. Use customer data and insights to activate journeys that reduce churn, boost adoption, and improve lifetime value.

Digital expectations reshaping financial experiences

61%

of all internet traffic comes from mobile, and 88% of mobile time is spent in apps

79%

lift in direct open rates from personalized notifications compared to untargeted messages

Proactive service deepens trust and loyalty

17%

Day-30 activiation rate from identified users (vs. just 4% for anonymous users)

59%

lift in purchase conversions when campaigns use customer preferences, with top performers reaching 91%

140%

higher purchase frequency from in-app messaging vs. no in-app messaging

What Airship customers are saying

Mobile banking experiences require a high-touch strategy that keeps customers informed, engaged, and reassured. Airship empowered us to transform the CIMB Clicks app into a virtual branch that balances the tailored service that customers expect from in-person interactions with the convenience of online operations.

Merlyn Tsai

Head of Consumer Banking & Digital

I remember the days that we had to look into each type of notification that we wanted to release and ask, ‘Can we scale it?’ With Airship, the teams know they can.

Eyal Sheinholtz

Director of Social Product Management